Simplify CX Operations

Management with intelligent automation of Interaction Insight

Connect all your communication channels, {Voice, Email, Chat, Social Media} to the TransMon AI-Driven platform to enable your operations, training, recruitment, and quality teams with actionable intelligence. Use intelligence from every interaction to drive your operations.

Trusted by

100% Coverage - All channels

Achieve complete visibility by unlocking valuable insights from all calls, tickets, chats, and emails. This enables you to Simplify CX Operations Management Process and drive improvements across the entire business.

Simplify CX Management

Automate Quality Assurance Processes Utilize AI and automation to identify critical interactions that require monitoring, enhancing productivity while maintaining human oversight and adherence to HR standards.

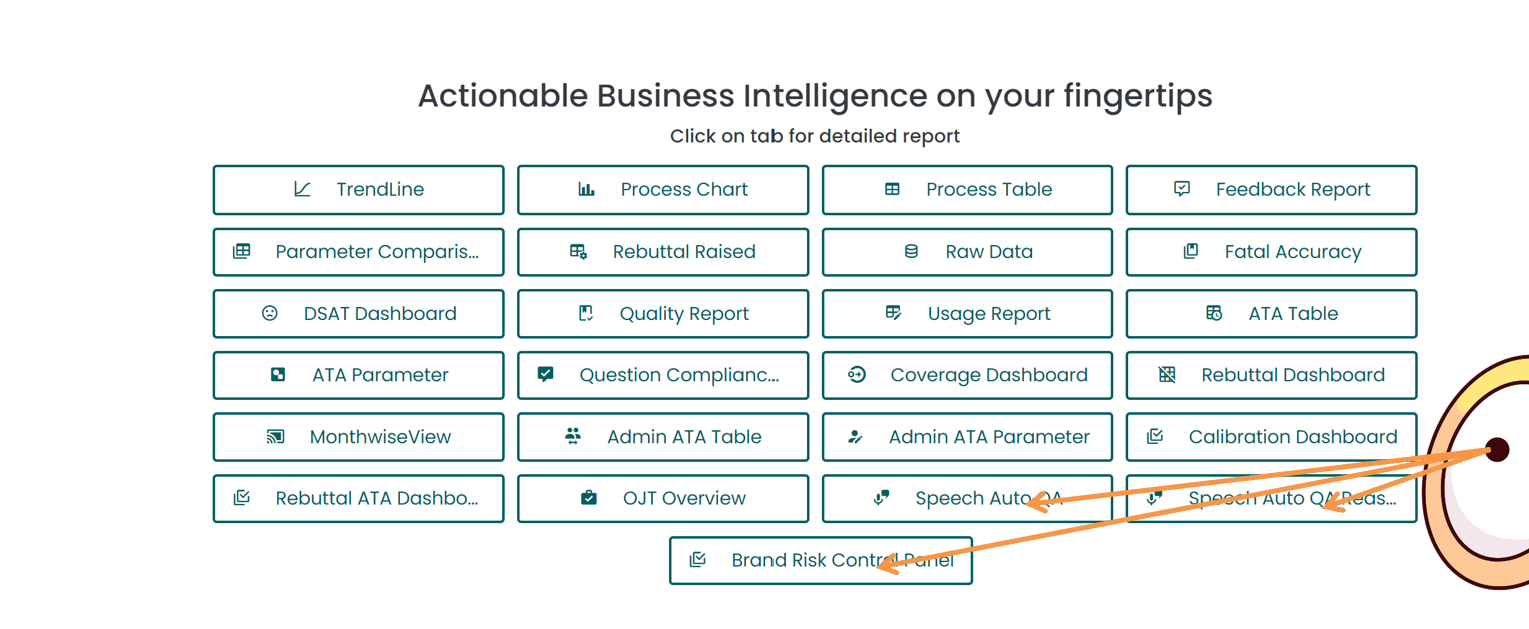

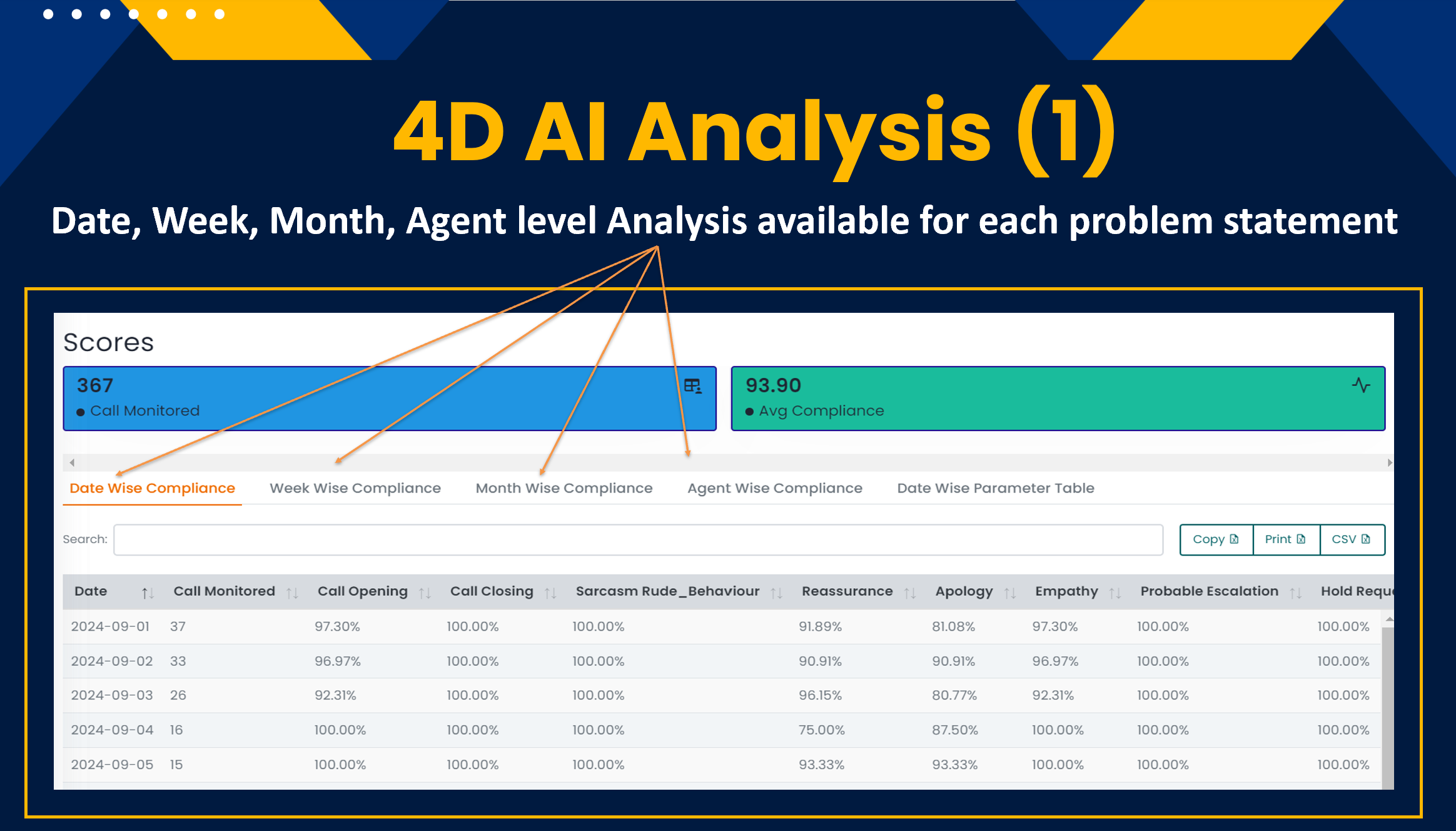

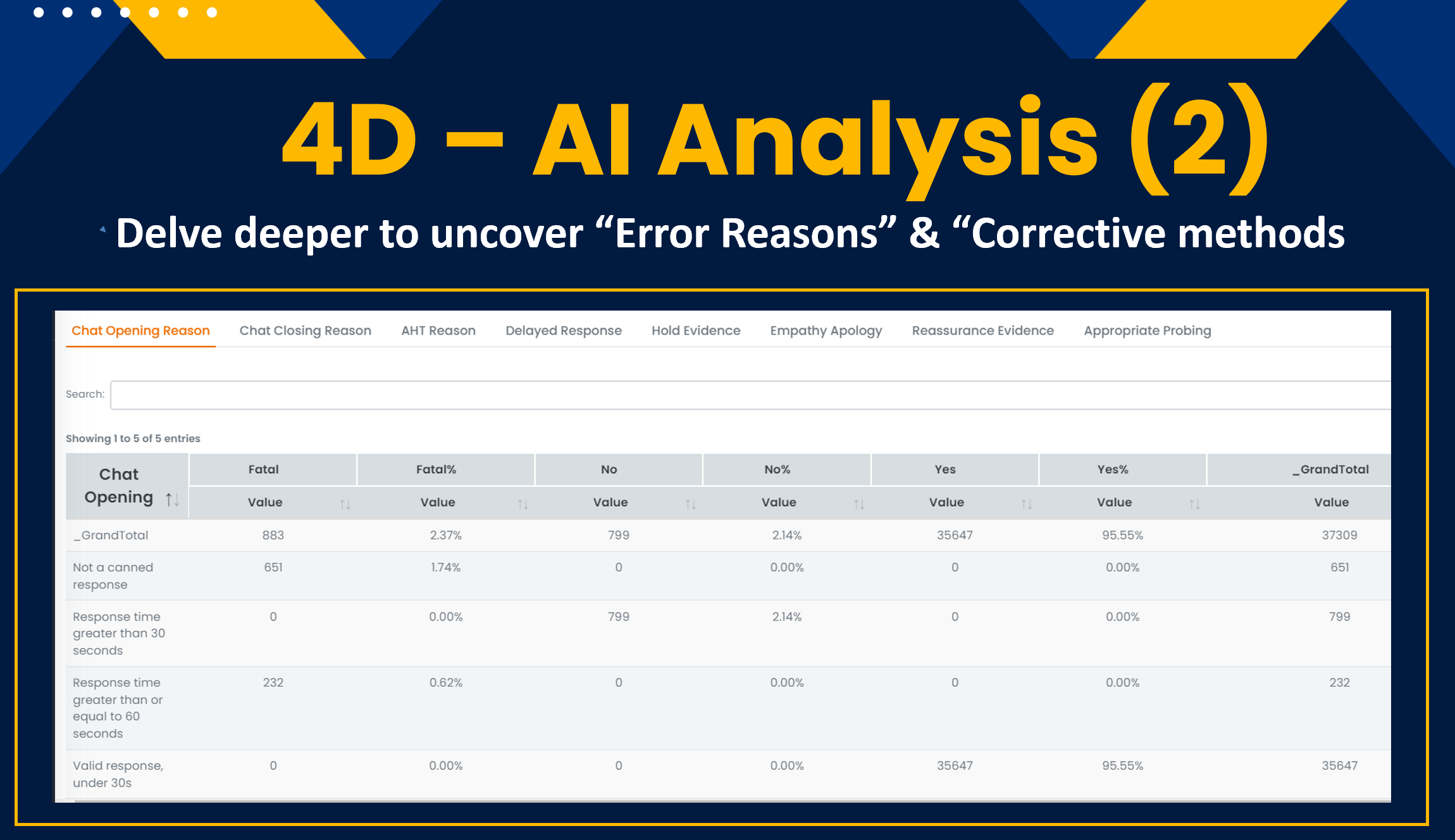

Drive results via AI Reporting

A fully integrated reporting suite to enable customer service, Sales and collections teams, leaders and coaches to turn insights into improvement.

Better performing agents

With real-time access to feedback, actions, and training records, empower your sales, collections and customer service agents to play an active part in your CX Operations management

How TransMon AutoQA helps you

Simplify CX Operations Management

Simplify your CX Operations Management

AI based Brand Risk Control Panel

Are our agents initiating calls with a clear and professional introduction, setting the right tone from the start? – CSAT Risk

Are our agents delivering warm and courteous greetings that make customers feel valued? – CSAT Risk

Are our agents providing appropriate reassurance to customers, helping to alleviate concerns and build trust during interactions? – CSAT Risk

Is our CSAT being skewed due to unethical solicitation by our customer service agents? – CSAT Risk

Are our agents requesting feedback surveys at the end of every transaction? Are they doing it for the appropriate transaction types, or even with already frustrated customers? – CSAT Risk

Are our agents intentionally using sarcasm, potentially alienating or frustrating customers? – Brand Risk

Trusted by

We have helped Ecommerce, Retail-Tech, Food-Tech, Ed-Tech, Quick Commerce, Banks, NBFCs and others

Simplify CX Operations Management

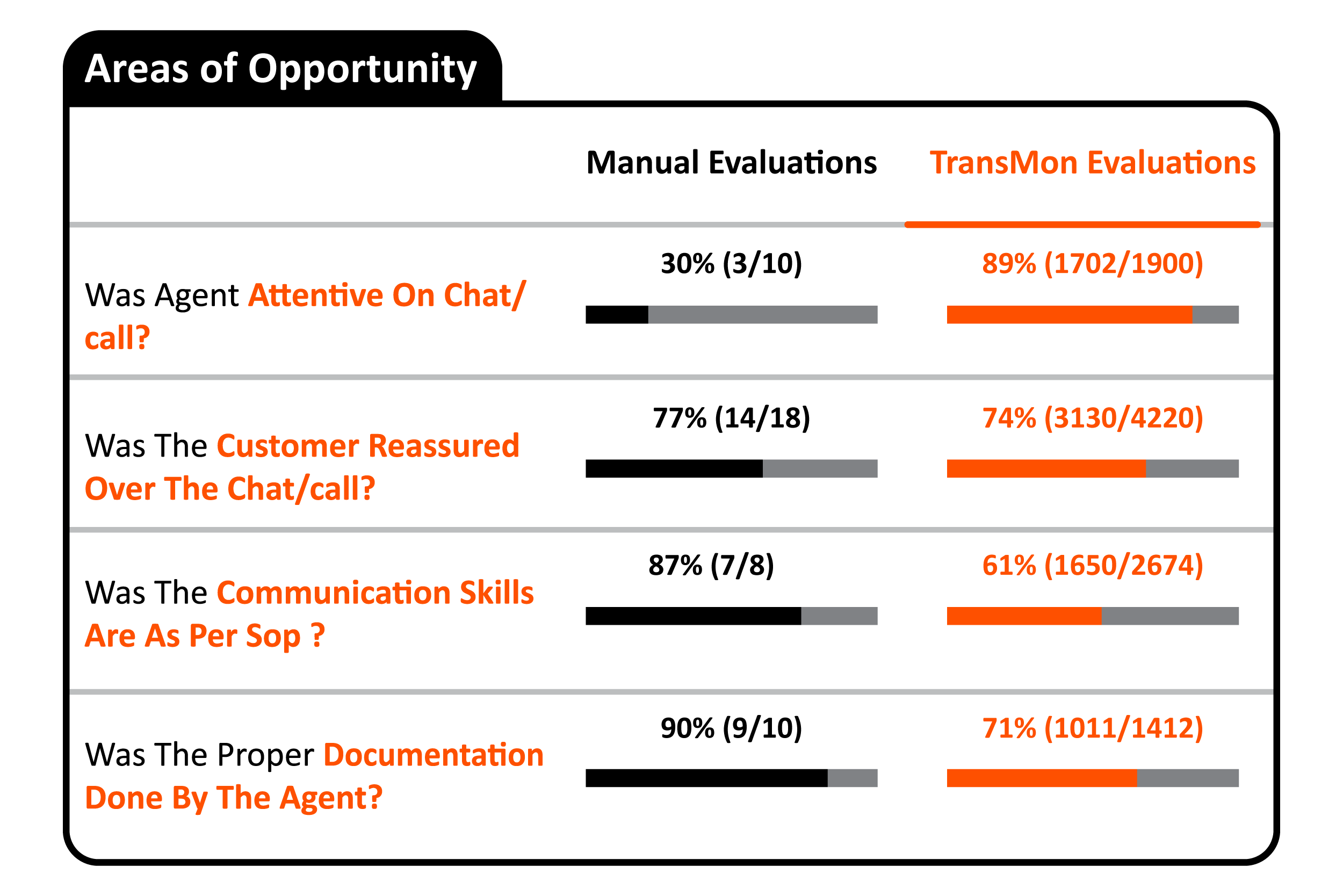

Maximize agent performance by coaching based on reality

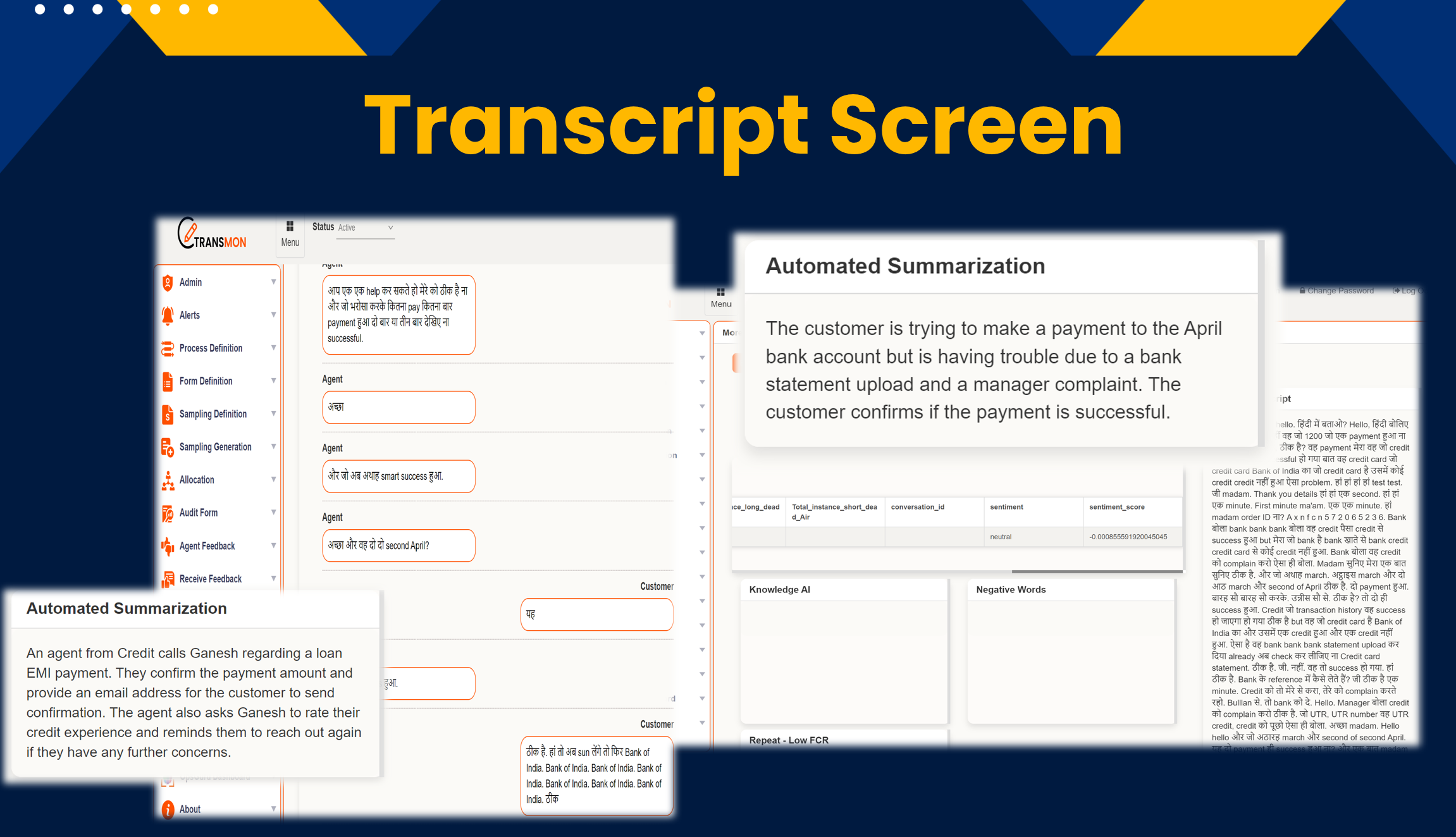

Empower supervisors and managers to provide proactive coaching at scale by leveraging the most robust insights on agent performance, powered by TransMon AutoQA technology for Quality Monitoring. With our solution, coaching workflows are optimized to help change behavior and drive better results.Gain Valuable Customer Insights by Analyzing Key Moments Across Calls and Chats

With our AI-based Moments, your customer touchpoints are no longer limited to a single channel. Our technology empowers agents to interact with customers across multiple channels, providing you with valuable market feedback and insights into what factors contribute to or detract from your customers' experience.